What Our Portfolio Companies Say

We have had considerable growth over the last two years and Jefferson Capital Partners was the perfect partner to help fuel our growth immediately and into the future. JCP shares our home base of New Orleans, which is particularly important to me. We are very proud and excited to have this partnership in place and adding a little spice to the life of many more customers in the future.”

Chris White

President/CEO

Louisiana Pepper Exchange, LLC

As we operate in a largely underserved market, we are very grateful for Jefferson Capital's support. JCP came in to help at the right time, in the right way. Their support was instrumental in many ways to help CSA move forward. We look forward to capitalizing on this momentum and the bright future that lies ahead.

Fred Riefkohl

President

CSA Group

They were great partners because they listened and took the time to understand our business.

Jeff Adinolfe

President

Atlas

Jefferson Capital helped us craft and execute an acquisition strategy to enhance the value of the business. In addition to providing their capital, they helped us negotiate the deal with the sellers and bring in the other financing sources to complete the transaction.

John McDonough,

President

Sagebrush

Working with Benson Capital and Jefferson Capital and their extensive networks will help accelerate our mission to empower advancements in human neuroscience.

This investment, along with our growing revenue and new federal grants, provides the capital we need to scale our platforms into industry-leading drug discovery solutions.

Lowry Curley, PhD

CEO

AxoSim

The professional and experienced guidance and support we have received over the past 5 years from JCP have not only been invaluable but also insightful and respectful as we achieved our financial goals. We are pleased to have reached this milestone and also delighted that we built long lasting relationships along the way.

Terry Moore

CEO

BE Peterson

Broad Industry Experience

Jefferson Capital welcomes the opportunity to invest in established companies in a variety of industries and provide comprehensive financial guidance to our partners. We have a track record of diversified investments across a broad geographical region. Industries in which Jefferson Capital has experience investing include, but are not limited to the following:

Manufacturing

Industrial Products

Business and Professional Service Industries

Wholesale/Distribution

Healthcare Products, Equipment and Services

Food Products

Applied Technology

Energy Services

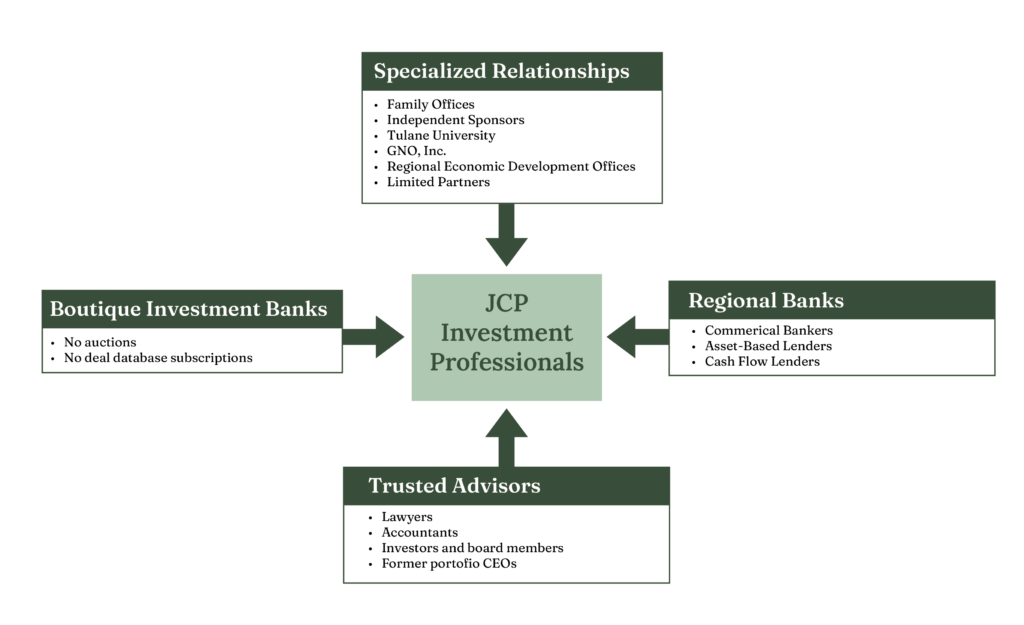

Deal Sourcing Relationships

Partnering with Small Businesses to Unlock and Build Equity Value

Strategic Advice

- Board creation and involvement

- Exit strategy planning and positioning

- Management team additions

- Strategy development and refinement

- Incentive programs to align interests

- Add-on acquisition assistance

Financial Guidance

- Monthly financial reporting

- Annual budgeting

- Audited financial statements

- Access to additional capital sources

- Working capital management

Operational Improvement

- Development of KPIs

- Lean processes and process improvement

- Technology and systems enhancements with data utilization

- Sharing of best practices

- Branding and marketing initiatives